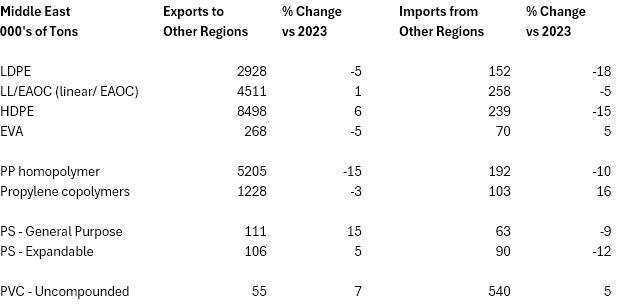

It was a challenging year for the world’s largest volume exporter of most grades of polyethylene and polypropylene. Weak demand in Asia-Pacific and competition from North America and Asia-Pacific resulted in a drop in Middle East exports of LPDE, EVA, polypropylene homopolymer, and propylene copolymers versus the prior year, and shifts in regional destinations.

The Middle East continued as the world’s largest exporter of LDPE, HDPE, polypropylene homopolymer, and propylene copolymers. (North America continued as the world’s largest exporter of linear/ethylene-alpha-olefin copolymers – LL/EAOC).

Middle East exports of LDPE were down 5% mainly on lower shipments to Asia-Pacific.

Exports of LL/EAOC rose 1%, slightly lower volumes to Asia-Pacific offset by a gain to Eastern Europe.

HDPE exports from the Middle East grew 7% on gains of 4-5% to Asia-Pacific and Europe, and of 26% to Africa (Egypt, Algeria, Ivory Coast, Ghana, Nigeria, Kenya, and others).

The largest drop in Middle East exports was in polypropylene, down 16%. Competition from Asia-Pacific negatively impacted Middle East exports to Western Europe, Eastern Europe, and Africa. Africa was also a polypropylene competitor, sending increased volumes to Eastern Europe. Competition from Asia-Pacific was the key factor in lower Middle East exports of propylene copolymers.

PVC was the Middle East’s largest commodity polymer import. Higher volumes from North America more than offset declines from Asia-Pacific and Western Europe, resulting in a 5% increase in the Middle East import total.

This series of blogs quantifies imports and exports of the major commodity polymers – LDPE, linear/ethylene-alpha-olefin copolymers (LL/EAOC), HDPE, EVA, PP, propylene copolymers (PRC), polystyrene, and PVC, for the geographic regions of Western Europe, Eastern Europe, Africa, North America, Latin America, Middle East, and Asia-Pacific.

From International Trader Publications’ continuously updated World Trade Analyses of all grades of commodity polymers.