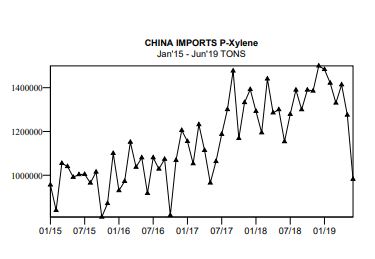

Imports for June 2019 fell to their lowest levels in two years

Monthly imports had been on an upward trajectory since 2015, peaking in January 2019 at 1.5 million tons, but volume in June plummeted to 980,000 tons:

China has made a significant manufacturing push in P-Xylene, looking to add 10 million tons of capacity between March 2019 and March 2020, and to triple capacity by 2025 (Reuters).

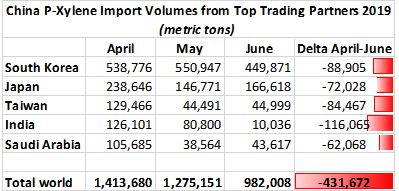

A look at monthly import volumes illuminates the impact of this push, especially in Asia Pacific. The table below includes China’s top 5 trading partners as of April 2019 and its global import total. From April through June, China’s imports are down over 430,000 tons:

Compared to June YTD last year, imports are down 32% for Taiwan, 28% for Singapore, 7% for Japan, and 3% for South Korea. They remain up for India (+29%) and Saudi Arabia (156%).

Notably, China imported over 81,000 tons of P-Xylene from the United States in 2018, but none in 2019. China assessed a 10% duty on imports from the US as of September 24, 2018.

From International Trader Publications’ P-Xylene World Trade Report, a continuously updated online analysis of global P-Xylene trade.