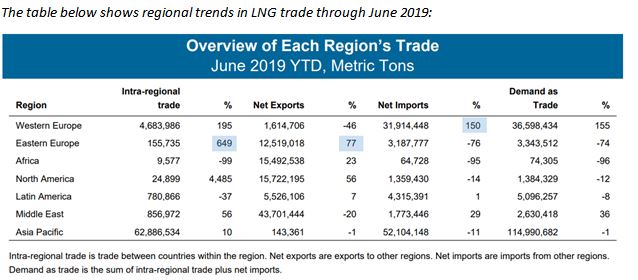

There was a significant spike in Eastern European exports of LNG that largely went to Western Europe, and, a pronounced increase in intraregional trade mainly between Russia and Lithuania.

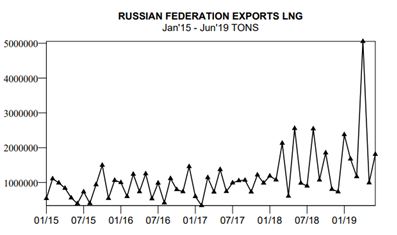

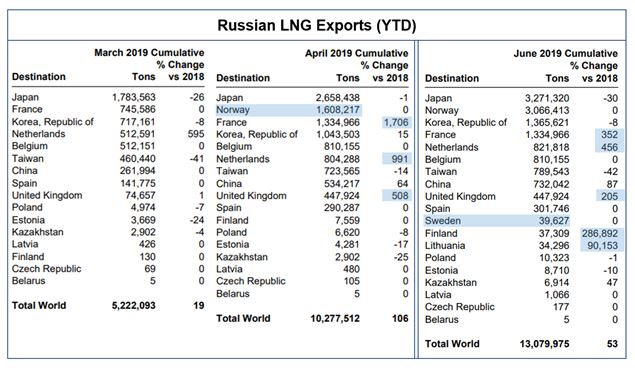

In March, Russia exported 1.17 million metric tons of LNG globally. Cumulatively, that amounted to 5.22 million tons, up 19% from the first quarter of 2018. in April, the monthly figure jumped to 5.06 million tons, with YTD exports totaling 10.3 million tons – an increase of 106% compared to the previous period. Russian exports of LNG had been up over the course of 2018 versus previous years, but the April 2019 spike dwarfed previous peaks. That spike coincided with the opening of Novatek’s Vysotsk LNG plant on the Baltic Sea the same month.

Western European countries were better represented in the list of top recipients of Russian LNG than the previous April, where the top 5 buyers were Japan, Korea, Taiwan, China and France.

Exports to France, Netherlands, and the UK Saw percentage changes on the previous year’s volume in the triple or quadruple digits, and a large quantity also went to Belgium.

According to Russian export figures for April, Norway saw significant volume for the first time in at least 20 years- though Norway reported no imports from Russia. But, simultaneously, the Netherlands reported imports of 1.53 million tons from Norway (up 565% from the previous period), with Norway reporting exports to the Netherlands of only 121,000 tons. What may be in play is ship-to-ship transfers of Russian LNG in Norway (as reported in Reuters), enabling more efficient transportation to the Netherlands as a major potential distribution hub.

Smaller volumes also went to Sweden (which had not seen Russian LNG imports for over a decade) and to Finland.

Countries in Asia Pacific remained top recipients, but Eastern European exports to Asia Pacific were down 13% through June compared to the first half of 2018. As of June, Russian exports to Taiwan were down by 42%, to Japan by 30%, and to Korea by 8%.

Intraregional trade within Eastern Eurrope has been picking up steam since the Russian expansion. As of April, it was up 163% YTD. By June, that figure had jumped to 649%.

The increase is largely accounted for by higher Russian exports to Lithuania (34,000 tons YTD by June, compared to 129 tons in all of 2018.) Reuters cites the Novatek NG shipments to Lithuania as marking an important step among Baltic states away from Gazprom, their sole source of gas for decades. Latvia also reported imports of 30,800 tons of LNG from Lithuania in June, compared with 20 tons in the rest of 2019 YTD.

While Russian exports have returned to previous levels in the subsequent months, Russia’s Energy Minister, Alexander Novak has outlined a plan to expand LNG output five fold, to 140 million tons by 2030 according to Reuters.

Written by Christiana Fierro. Data from International Trader Publications’ LNG World Trade Report, continuously updated on line analysis of global LNG trade.